Opinion | Financial Literacy is Fundamental for Life After High School

Financial Literacy is a must for kids in this progressing century; a skill many need—but don’t have.

April 17, 2023

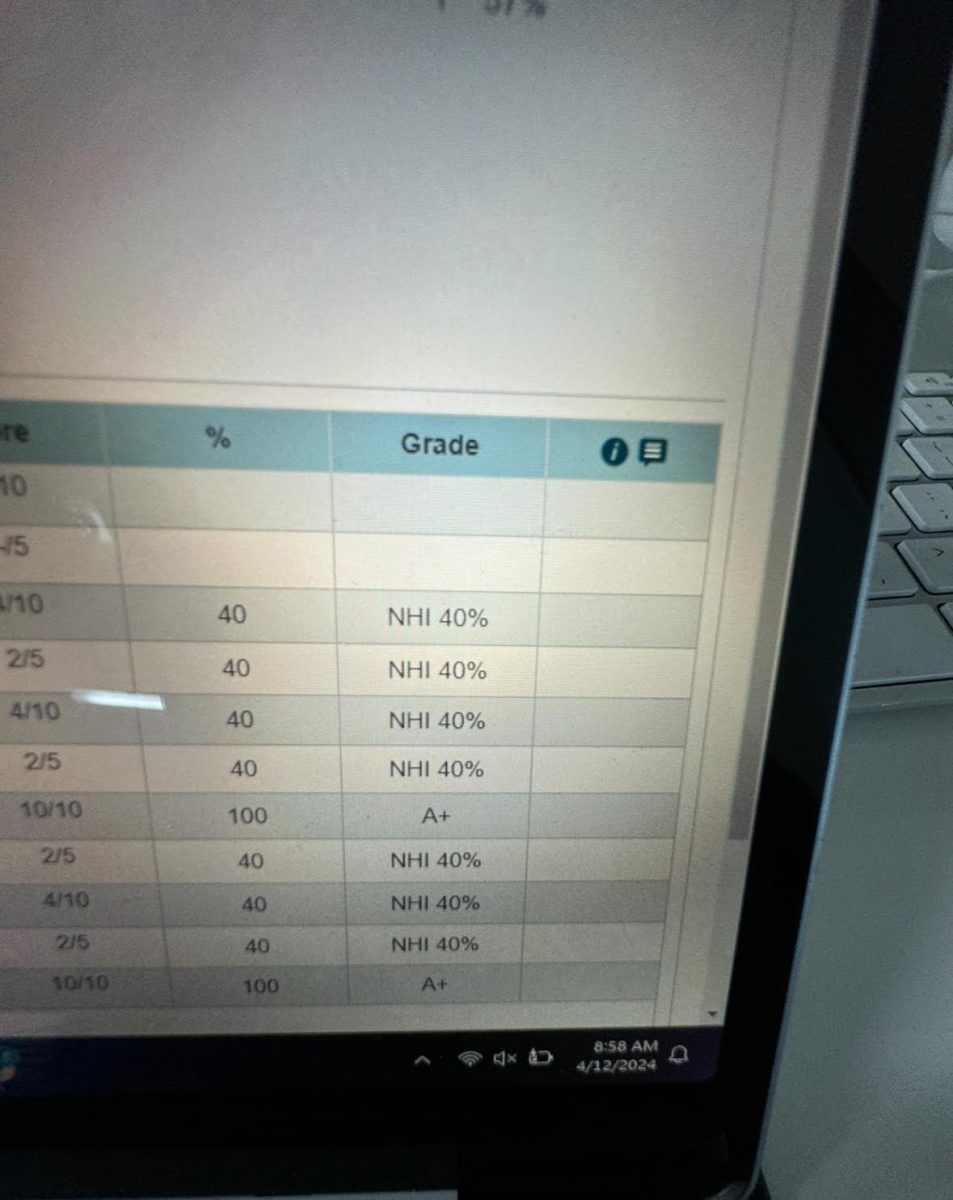

60% of U.S. adults live paycheck to paycheck; oftentimes because of uninformed ideas about finances and their implications in spending, saving, and investing habits. Financial literacy must be taught in order to give students a better idea on how they should be using their money in post-high school life.

This loss in financial learning is caused by one of the major flaws in the education system, which is the fact that math could be used for more realistic, real-life scenario learning rather than just a grasp on algebra. This sentiment is felt by teachers, parents, and students alike as reported by USA Today which raises concerns about whether or not reforms are imperative in order to give students more preparation for the real world.

Pragmatic reforms such as the implementation of budgeting activities, learning about debt and the best ways to minimize it, how to reduce loans—chiefly student loans—and become better at saving and investing allows students to learn to build wealth now as a financial basis for the rest of their lives. Additionally, it can help bridge the gap of unmotivated learning in math classrooms as it brings an atmosphere of beneficial and practical skills that students will actually use.

So, as society progresses and strives to supply students with a better understanding of the world, these changes would be a step in the right direction for the next generation—especially since many are opting out of college altogether with programs such as CCIC that launch them straight into their careers.